Equipment is an item of non-expendable, personal property having a useful life of more than one year and an acquisition cost that is $5,000 or more per unit.

Does my purchase meet capitalization criteria?

Examples of capital expenditures

- Scientific equipment

- Copy Machines

- Vehicles

- Fabricated (constructed) equipment

Including:

- Freight

- In-Transit Insurance

- Multiple items purchased on one purchase order that work together as a unit with a combined cost of $5,000

- Any modification or accessories necessary to make the equipment usable

- University shop charges

- Operating software purchased with hardware with a combined cost of $5,000 or more

Examples of NON-capital expenses

- Extended Warranty

- Maintenance agreement

- Software licenses

- Accessories less than $5,000 purchased separately from the original PO

- Replacement parts

- Repairs

- Contract deliverables

- Training/Familiarization

- Professional services

- Tools with a cost less than $5,000 for building constructed equipment

- University labor expense (salary expense)

- Software purchased separately with a cost less than $100,000

- PCs, laptop computers, or tablets with an original cost of less than $5,000 per unit

- Furniture and fixtures

Equipment purchases are reviewed by the CAA. If the purchase is determined to be equipment, the expense will be capitalized and an asset will be created in the Property Management System (PMS). Any equipment that does not meet capitalization criteria will be moved to supplies during Financial Services' review.

Screening procedures should be followed for Federal awards to avoid the purchase of duplicative or unnecessary equipment. Departments are responsible for screening procedures as well as determining if additional Federal approvals are required prior to purchase.

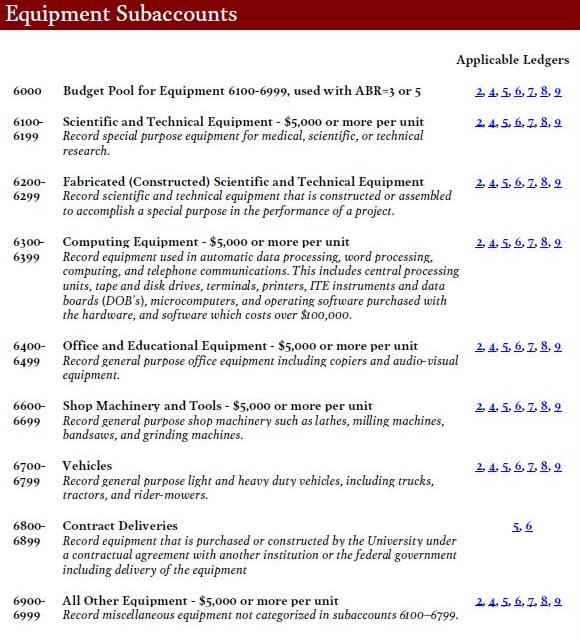

When purchasing equipment, please refer to the following chart for subaccount coding.